The State of Funding in Social Business Software

The State of Funding in Social Business Software:from Web Strategy by Jeremiah

Executive Summary:

Social Business Software vendors (Startups that offer social technology software and solutions for corporations to use to interact with employees, customers, and partners) have raised on average $14m with the most common round being an A-Round at $5.2m. A few vendors have received large D-Rounds, however most are receiving $5-10m rounds from a series of investors. Brands must ask vendors at least 5 questions on who and how this money is and will be used, to understand the strategy before buying.

[Funding in social business software is an indicator of a Vendor's potential to quickly accelerate to meet the needs of corporate customers]

Why this Research:

As an Industry Analyst, I look at The Three Spheres of Web Strategy of the market to understand it: 1) Consumer behavior (who brands want to reach 2) Brand appetite (customers of software vendors) 3) Technology providers (those who aid brands, like these players). On a weekly basis I interact with Brands, Media, Software Vendors, and Media to exchange information. I wanted to bring some hard data to the conversation on the funding aspect which fits in the technology sphere.

[Investor relationships with software vendor shape the direction by providing guidance, network access, and may guide a 'material event']

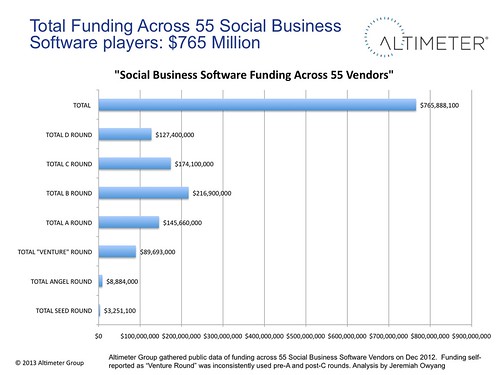

Above: Figure 1 indicates that across these 55 startups, the total funding amount was $765. Please read method and scope below to understand this is not the full space.

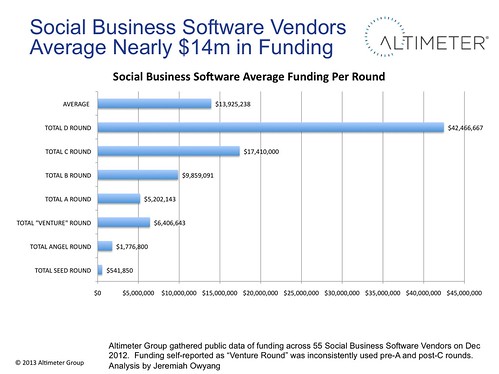

Above: Figure 2 indicates that on average, Social Business Software vendors have raised $14m in funding.

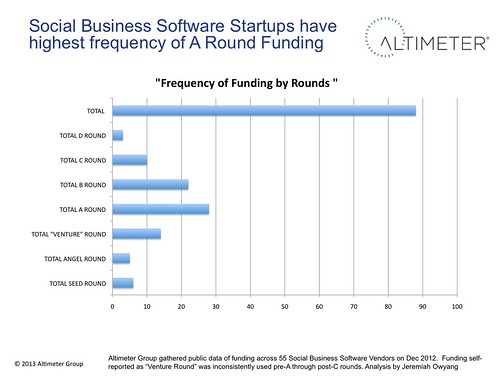

Above: Figure 3 indicates that on average, the average funded round is the A-Round.

Market Findings:

After probing the data for hours, I found some interesting trends in the market worth notating.

- Total Funding across these 55 active vendors is $765m. with most funding occurring in last few years however some vendors like Lithium have been present for over a decade. This is a relatively small amount of funding in the VC space, as some giants like Andreessen Horowitz are managing over $1b for a fund, and my finger to the air estimate is that many a Sand Hill VC average around $400m per fund in my space.

- Funding is significantly smaller compared to consumer cousins. For comparison, Facebook received a total of $2.2b of funding, and Groupon with $1.14b and Zynga with $860m. I’d argue that the returns on B2B players revenue (on a percentage basis) may be higher. While bluechipper Facebook is on track for a potential $4b runrate, but Zynga and Groupon have questionable destinies. Furthermore, the startup costs for Social Business Software vendors is low with open software, cloud infrastructure, and sometimes virtual workforces.

- On average, vendors raised $14m across all rounds. On average, these startups took a relatively modest amount of revenue over the lifetime of their companies. While the scope of startups includes both established and early stage, $14m is a relatively modest amount when software salaries, the high rent in coastal cities, and compared to consumer startup giant funding, is relatively small. Many vendors boast annual revenue streams of about $5m-$10m of SaaS best repeatable revenues in my interactions over past 5 years, with exceptions on both ends.

- The A-Round is most commonly funded round. The A-Round investments lead the back, 8 of the total 88 investment events (33%) were at the A-Round at $5.2m. This crucial round demonstrates to the investors that they’ve received corporate traction in an addressable market, and are ready for faster growth to keep up. For further momentum, the most common round was a B-Round which comprises of 22 of 88 events, (25%). Although there are fewer D rounds, the average value exceeded $42m, a goliath size readying the company for a material event.

- D-Rounds lead the largest portion of overall funding dollars. This later stage fund is often ‘double down’ money by VCs who look for companies that have proven their mettle and are ready for expansion at a rapid pace. (product, sales, territory, aboard offices and M&A), or are preparing for sale to third parties (Salesforce, Oracle, IBM, Adobe have rapidly entered this space). In some cases, late stage dollars increase overall value of software firm to raise valuation amounts before a material event.

- Confusion over terminology of funds makes tabulating not clear. The amorphous term “Venture Round” spanned funding that was pre-A and even post-C (like Gigya). In some cases, some vendors received only 1 round of funding and titled it Venture Round, which could be assumed as A. In some cases Venture Round was an extension of a A-C round (Gigya’s latest large round was listed as a venture round, post-C), and while that data is likely listed in the S-1, I chose not to dive into it to dissect for purposes of this industry level data.

- Only 18% of Startups had a Material Event (M&A, IPO). For some startups the mecca is a reaching a material event, which would involve M&A or IPO. While it may seem like there’s been a rash of M&A activity, in this particular data set, only 7 of the 55 vendors (12%) have been acquired and a notable IPO of Bazaarvoice with the media questioning the performance of stock, also LiveWorld went IPO nearly a decade ago. So that’s 10 materials events out of 55 companies, a 18% rate. Granted, a few vendors that were acquired did not make this list, but overall, there’s been few material events. (edits made to this section, see footnotes)

Brands are making million dollar commitments to these software vendors, and often their careers, and quality of worklife will pin on choosing the right vendors. Beyond features and functions, buyers must pay attention to the root of funding as it shows financial stability, ability to grow, and credibility from third party investors who also believe in the company. As vendors pitch brands their software and services, it’s important to carefully pay attention to the slide on funding, as it helps to give an anchor point on where the firm has come from, and how fast they may grow in the future.

- How much have you raised and from whom? What other software companies are in the VCs portfolio are related? Find out who has invested and look at their websites for a track record of successful investing in enterprise software. They’re often key advisors, or make connections for the startup, you’ll want to know every angle.

- What is that money going to be used for? How have you used it in the past? How will this help customers? As you look under the hood, find out how they’ve used investor dollars in the past, and look for key acceleration points, if you don’t see this, raise a red flag. For recent funding, ask how they’ll strategically use this.

- Do these investors advise your company on a frequent basis? Are they on the board? Ask specifically what each round was used for, and what were the business impacts. As firms raise new money, have a frank discussion on how they’ll use it going forward.

- So you raised a big ton of money, are you going to sell the company? If a vendor has raised significant money as a later stage, have a frank discussion on their exit, while IPO is no longer attractive in today’s market conditions, we’ve seen a number of acquisitions occur which will impact customers.

- You haven’t raised much at all, why? If a company has not raised much funding, find out why and how. Question if they’re going to match growth rates with competitors who have cash on hand to do expansions and potentially purchases of competitors. In some cases, vendors have inability to raise much money, due to VCs passing up on the deal, due to issues, it’s key you track this.

First, we developed a data set of vendors based on feedback from my initial vendor set who we hear about from clients, press, and VCs, as well as took in input from Altimeter’s research team. Then, I commissioned a researcher to conduct public research to collect all this data with sources and I vetted data content.

This research was conducted across 55 social vendors spanning 6 sub-categories including: Social Media Management Systems (like Sprinklr, Hootsuite, Buddy Media), Social Commerce (Bazaarvoice), Social Integration (Gigya, Janrain, Echo), 2 Gamfication (Badgeville, Bunchball), Community Platforms (Lithium), Listening (Radian6, Social Bakers). A majority of the sample set are SMMS vendors who are the most active funded at this time. The time tables on these funding notes typically span 1-5 years, but there are records of some longer term vendors that were included that have been funded over 10 years ago.

This study does not include funding from consumer startups Facebook, Twitter, Groupon, Zynga who all leave these other vendors dwarfed with total funds amassed. This is only a sample of 55 vendors out of 100s, the total sample size was intentionally limited vendors on my ‘coverage radar’.

I’d like to thank the following people for their assistance: Jennifer Jones for her guidance on the VC landscape, Nadim Hossain (seasoned Social Business Exec), Blake Bartlett (Battery Ventures), Andrew Jones (Altimeter Researcher), Christine Tran (Altimeter Researcher), Julie A for data research.

Social Business Software Vendors Evaluated (55):This research was conducted across 55 social vendors spanning 6 sub-categories including: Social Media Management Systems (like Sprinklr, Hootsuite, Buddy Media), Social Commerce (Bazaarvoice), Social Integration (Gigya, Janrain, Echo), 2 Gamfication (Badgeville, Bunchball), Community Platforms (Lithium), Listening (Radian6, Social Bakers). A majority of the sample set are SMMS vendors who are the most active funded at this time. The time tables on these funding notes typically span 1-5 years, but there are records of some longer term vendors that were included that have been funded over 10 years ago.

This study does not include funding from consumer startups Facebook, Twitter, Groupon, Zynga who all leave these other vendors dwarfed with total funds amassed. This is only a sample of 55 vendors out of 100s, the total sample size was intentionally limited vendors on my ‘coverage radar’.

I’d like to thank the following people for their assistance: Jennifer Jones for her guidance on the VC landscape, Nadim Hossain (seasoned Social Business Exec), Blake Bartlett (Battery Ventures), Andrew Jones (Altimeter Researcher), Christine Tran (Altimeter Researcher), Julie A for data research.

- Actiance

- AddThis

- Alterian

- Argyle Social

- Arktan

- Awareness Networks

- Badgville

- BazaarVoice

- Buddy Media

- BumeBox

- Bunchball

- Campalyst

- Context Optional

- Converseon

- ConverSocial

- CoTweet

- Curata HiveFire

- Dialog Solutions

- Echo (Aboutecho.com)

- Engage Sciences

- Expion

- Extole

- FALCON Social

- FeedMagnet

- Friend2Friend

- Gigya

- HearSay Social

- Hootsuite

- HYFN8

- Janrain

- Jive

- Lithium

- LiveFyre

- Liveworld

- Mass Relevance

- Meltwater Buzz

- Nielsen Buzzmetrics

- Radian6

- Shoutlet

- Sociable Labs

- Social Bakers

- SocialVolt

- Spredfast

- Sprinklr

- SproutSocial

- Syncapse

- Targeted Group

- Telligent

- ThisMoment

- TigerLily

- Tracx

- UberVU

- Vitrue

- WildFire

Funding across category types, top VCs funding Social Business Space, profile of the top 5 Funded Social Business Software startups. Please check out my full body of research to learn more about my coverage.

(Update: I discovered another material event after posting this, and have updated these numbers to correctly list 18% –prior was incorrectly listed at 16%, Jan 10, 2013)

No comments:

Post a Comment